Pennsylvania law provides for two alternative methods of execution on a confessed judgment against personal property.[1] After judgment has been confessed and the creditor wants to proceed with execution, the creditor must decide whether to proceed with the 30 day notice procedure under Pennsylvania Rule 2958.1 or proceed with immediate execution under Pennsylvania Rule 2958.3. There are advantages and disadvantages to both procedures. How the creditor should proceed depends on a multitude of factors unique to each case.

The 30 day Notice Procedure

If the creditor decides to proceed under Rule 2958.1, it must serve written notice upon the judgment-debtor at least 30 days prior to filing a Writ of Execution on the judgment. The notice can be served by the sheriff, certified mail, or pursuant to a special order of court. Once the creditor has served notice under Rule 2958.1, it cannot file its Writ of Execution until the thirty day period has expired.

Immediate Execution Procedure

Under Rule 2958.3, the Writ of Execution is served immediately with the notice of execution. Use of this procedure also requires service of a form of a petition to strike the judgment and request for a prompt hearing. The petition to strike form is a certification by the judgment-debtor that he/she/it did not voluntarily, knowingly and intelligently waive the right to notice and hearing prior to the entry of judgment. If the judgment-debtor files the form with the sheriff, the court is required to hold a hearing regarding the petition within three business days. Execution is stayed during the period between the filing of the form petition and the prompt hearing.

At the prompt hearing, the only issue to be decided is whether the judgment-debtor voluntarily, knowingly and intelligently waived the right to notice and hearing prior to the entry of judgment. It is the creditor who bears the burden, by a preponderance of the evidence, of proving a knowing, voluntary and intelligent waiver. If the creditor does not meet this burden of proof, the judgment will be stricken.

After service of the notice of execution, under either procedure outlined above, the judgment-debtor has 30 days in which to file a petition to open or strike the judgment. If a petition to open or strike is filed after the 30 day period following service of the notice, it will be denied by the court unless there are compelling reasons for the delay.

The History of Confession of Judgment in Pennsylvania and the Creation of the Two Procedures for Execution

Pennsylvania’s confession of judgment procedure has withstood constitutional attack in the past. However, in 1994, the Third Circuit Court of Appeals held that while the entry of judgment by confession was not unconstitutional, the entry of judgment together with immediate seizure of personal property without providing a means for obtaining a prompt hearing for relief, violated the Due Process Clause of the U.S. and Pennsylvania Constitutions. See, Jordan v. Fox Rothschild, 20 F.3d 1250 (3d Cir. 1994).

In 1996, the Pennsylvania Rules of Civil Procedure were revised to address the requirements set forth in the Jordan case. The two alternative procedures for execution against personal property were created under Rules 2958.1 and 2958.3. The prompt post-seizure hearing provided for in Rule 2958.3, which authorizes immediate execution, is an attempt to address the due process concerns raised in Jordan. However, there has not been a ruling by the Court that the new rules sufficiently address the issues raised in Jordan. Consequently, there is still a risk associated with engaging in immediate execution upon a confessed judgment.

Contrasting the Two Procedures

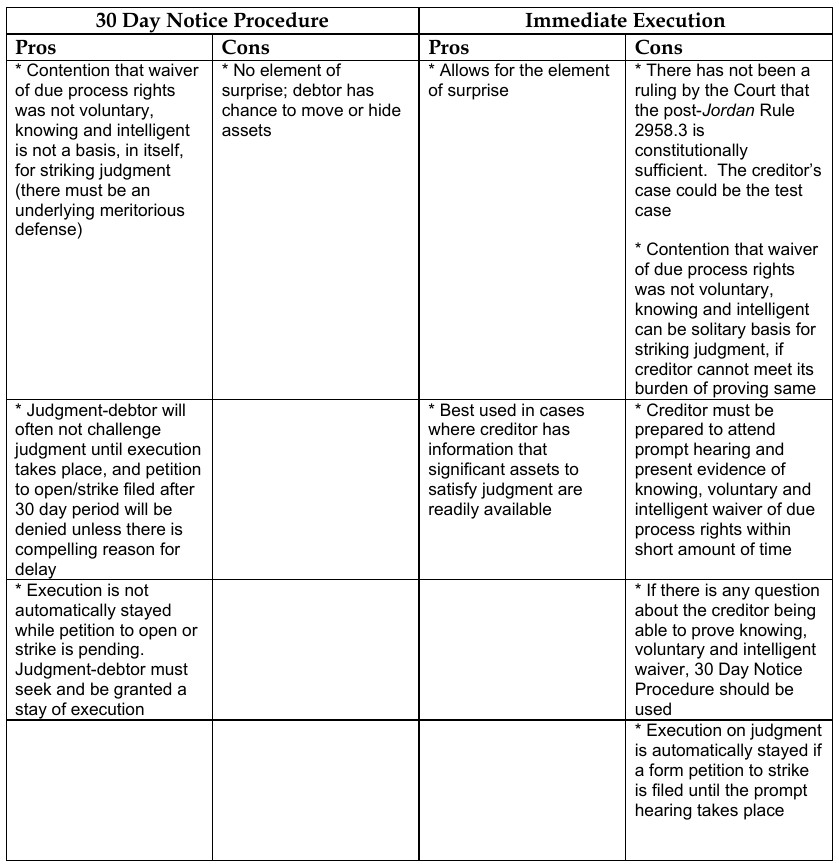

Below is a list of pros and cons for each method of proceeding:

[1] Actually, there is a third method of execution under Rule 2958.2 that is applicable only when the property to be levied upon is real property. This article will only deal with execution against personal property under Rules 2958.1 and 2958.3.

Kristen Ladd is an associate at Unruh, Turner, Burke and Frees, Kristen practices in the areas of Pennsylvania Litigation, and Pennsylvania Creditors’ Rights and Bankruptcy Law. The firm maintains law offices in Malvern, Phoenixville, and West Chester Pennsylvania which serve the Main Line, and many surrounding communities such as Devon, Exton, West Chester, Ardmore and others.